The London real estate talent market continues to show high candidate availability alongside selective hiring activity, particularly at junior and mid-level roles.

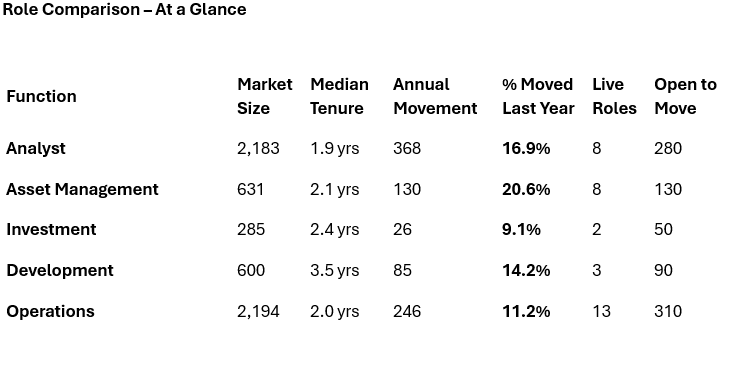

Across nearly 5,900 professionals analysed, the average median tenure stands at 2.4 years, with approximately 14% of the market changing roles annually. This movement is most pronounced within Analyst and Asset Management functions, where over one in five professionals changed roles in the last year, driven by promotion opportunities and competitive hiring.

In contrast, Investment and Development roles demonstrate greater stability, with longer tenure and lower annual movement. This seems to reflect longer investment cycles, and a hiring approach that remains largely relationship-driven rather than vacancy-led.

Despite this mobility, advertised demand remains limited. At the time of analysis, only 34 live London roles were visible across all functions, compared with 860 professionals indicating openness to new opportunities. This imbalance has created a candidate-rich but employer-selective market, where hiring processes are increasingly competitive and brand-led.

Gender representation continues to vary significantly by function. Operations roles show the strongest balance, with women representing 45% of the market. However, representation declines consistently with seniority, falling to just 22% female participation within Investment roles, highlighting an ongoing structural challenge for the sector.

For employers, the implications are clear:

Junior and mid-level talent requires stronger retention strategies, underpinned by clear progression and development pathways.

Senior hiring must be proactive, often engaging talent well ahead of formal hiring needs.

Speed, clarity, and flexibility are key differentiators in securing top candidates.

Meaningful progress on diversity will require focused intervention at mid-career levels, not just entry points.

Cross-Market Themes

Talent Mobility

Highest turnover: Asset Management & Analysts

Lowest turnover: Investment & Development

Gender Representation

Strongest balance: Operations

Weakest representation: Investment Management

Diversity declines consistently with seniority

Supply vs Demand

Across all functions:

Candidate availability exceeds live roles, suggesting:

Selective hiring

Increased competition between candidates

Opportunity for employers to raise hiring standards

.png)

Sources: LinkedIn, Falmouth Fairfax